How EV Finance Helps You Save ₹2–3 Lakh Over 5 Years ?

For many Indian buyers, the biggest question before switching to an electric vehicle is cost. While EVs may appear slightly expensive upfront, the real savings become clear over time. With the right EV finance option, buyers can save anywhere between ₹2–3 lakh over five years compared to petrol or diesel vehicles.

EV finance spreads the vehicle cost into affordable EMIs while allowing owners to benefit immediately from lower fuel and maintenance expenses. This combination makes electric vehicles one of the smartest financial choices in 2026.

How Does EV Finance Help You Save ₹2–3 Lakh?

EV finance helps buyers save ₹2–3 lakh over five years by reducing fuel expenses, lowering maintenance costs, and spreading the vehicle cost through predictable monthly EMIs. Electric vehicles cost significantly less to run than petrol vehicles, and government subsidies further reduce the finance amount.

Fuel Cost Savings: The Biggest Advantage

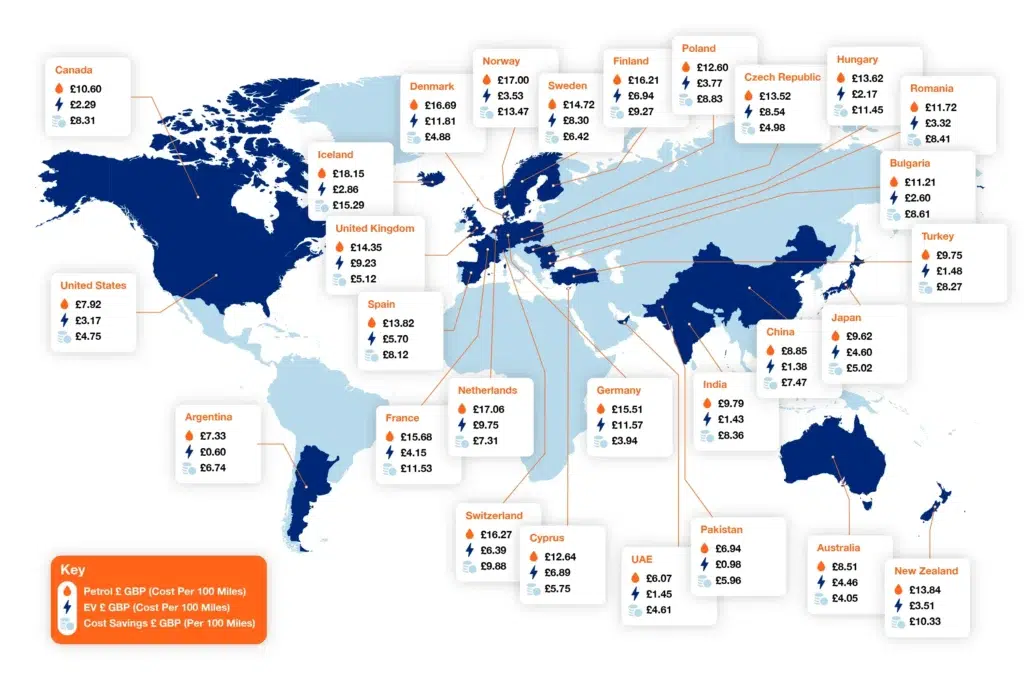

Fuel is the largest recurring expense for petrol vehicle owners. With rising fuel prices across India, daily commuting becomes expensive. According to official data on electric vehicle charging infrastructure in India,charging an electric vehicle costs a fraction of petrol expenses.

On average, petrol two-wheelers cost ₹2–3 per kilometer to run, while electric vehicles cost less than ₹0.50 per kilometer. Over five years, this difference alone can save ₹1.5–2 lakh.

Lower Maintenance Costs Add Up

Electric vehicles have fewer moving parts compared to petrol vehicles. There is no engine oil, clutch, gearbox, or exhaust system to maintain.

- No regular oil changes

- Fewer service visits

- Lower risk of mechanical breakdowns

Over five years, EV owners typically save ₹40,000–₹60,000 on maintenance. These savings directly improve the overall value of EV finance.

EV Finance EMI vs Monthly Petrol Expenses

One of the most surprising benefits of EV finance is that the EMI is often similar to what petrol vehicle owners already spend every month on fuel and maintenance.

| Monthly Expense | Petrol Vehicle | Electric Vehicle |

|---|---|---|

| Fuel / Charging | ₹2,500–₹3,000 | ₹400–₹600 |

| Maintenance | ₹700–₹1,000 | ₹200–₹300 |

| EV Finance EMI | Not Applicable | ₹2,800–₹3,200 |

In many cases, the savings from fuel and maintenance nearly offset the EMI, making EV ownership financially comfortable.

Government Subsidies Reduce the Finance Amount

The Indian government actively promotes electric mobility through financial incentives. Eligible subsidies under government EV subsidy schemes are deducted from the vehicle cost before calculating the finance amount.

- Lower loan principal

- Reduced EMI

- Lower total interest paid

These benefits further increase long-term savings when you opt for EV finance.

Commercial Users Save Even More with EV Finance

For delivery partners, fleet operators, and small business owners, EV finance delivers even higher savings. Commercial vehicles cover more kilometers daily, which amplifies fuel and maintenance savings.

Many commercial EV users recover their monthly EMI entirely through operational savings, turning EV finance into a profit-enhancing decision rather than an expense.

EV Finance vs Traditional EV Loan

While a standard EV loan helps with vehicle purchase, EV finance focuses on total cost efficiency by aligning EMI planning with long-term operational savings.This makes EV finance more suitable for buyers who want predictable expenses and better financial outcomes over time.

Is EV Finance Worth It?

EV finance is worth considering if you:

- Commute daily

- Want predictable monthly expenses

- Are buying your first vehicle

- Use a vehicle for business or delivery

In all these cases, EV finance helps reduce upfront burden while maximizing long-term savings.

Key Takeaways

- EV finance spreads vehicle cost into affordable EMIs

- Electric vehicles save ₹1.5–2 lakh on fuel over five years

- Lower maintenance saves ₹40,000–₹60,000

- Government subsidies reduce total finance cost

- Total savings can reach ₹2–3 lakh over five years

Conclusion: EV Finance Turns Savings into Reality

EV finance is not just a way to buy an electric vehicle—it is a smart financial strategy. Lower fuel costs, minimal maintenance, government incentives, and predictable EMIs together help buyers save ₹2–3 lakh over five years. WithRiseWise,buyers can access flexible EV finance solutions that make the transition to electric mobility affordable, stress-free, and future-ready.